1000+ Investors, ₹500 Cr+ Invested, 1 Common Goal “Financial Growth”

From salaried professionals to NRIs and entrepreneurs —

people trust Money Coach to make smart financial decisions.

Rise With Money Coach

Why Let Inflation Win?

Start Investing Smart Today

Fixed Deposits and Gold alone aren’t enough to grow your wealth. At Money Coach, we help you make your money work smarter. Through Mutual Funds, Insurance, FDs, and Loans against Mutual Funds, we create strategies that aim to beat inflation and secure your financial future.

Compliant

Registered (ARN: 158059)

AUM Managed

10+

Years of Experience

Meet Us

Smart Investment Solutions, Made Simple

We offer personalized financial guidance and investment strategies designed to simplify your decisions, grow your wealth, and help you achieve your long-term financial goals with confidence.

Why Choose Money Coach ?

- AMFI Registered (ARN: 158059)

- Personalized Plans & Regular Check-ins

- Partnered with Top AMCs

- Expert Guidance in Mutual Funds, Insurance, FDs & Loans

Why Mutual Funds?

Because They’re Built to Grow.

Money Coach helps you invest smartly in mutual funds — long-term, goal-oriented, and professionally managed solutions designed to grow your wealth while staying AMFI-compliant.

Higher Returns Over Time

Build long-term wealth with professionally managed, market-linked growth.

Expertly Managed Funds

Our experienced advisors handle your investments, so you can focus on your goals.

Wide Variety — Equity, Debt, Hybrid

Choose funds that suit your risk profile, goal, and investment horizon.

Start Small, Grow Big

Invest from as little as ₹500 and grow steadily with discipline and time.

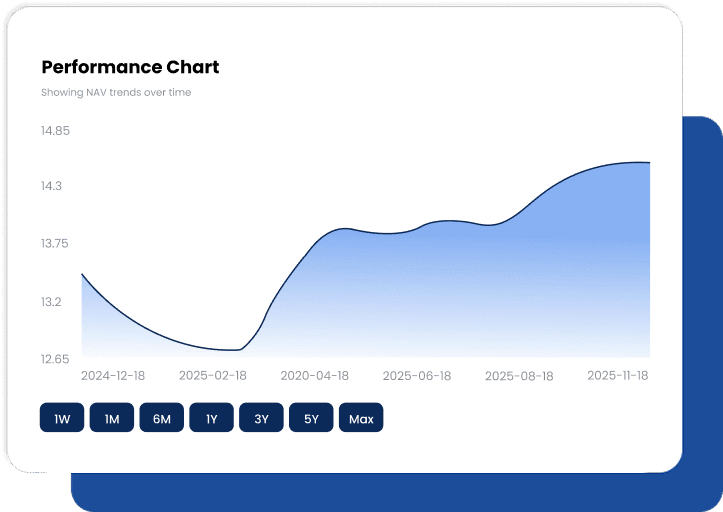

Top Performing Funds

Which Fund Type Matches You?

Pick what fits your risk, return, and timeline. We simplify fund selection by matching you with top-performing options that align with your goals and comfort level.

No fund data available

DIY Platforms vs Guided Investing

Why Choose an MFD?

You can choose funds on your own. Or you can work with someone who does this every day — and helps you avoid big mistakes.

| Parameter | DIY Platforms | With a MFD Like Us |

|---|---|---|

| Fund Selection | Self-research | Guided by experts |

| Risk Profiling | Basic quiz | Personalized advice |

| After-sales Support | Chatbot | 1:1 human advisor |

| Discipline | On your own | Regular check-ins |

| Portfolio Checkups | Manual | Done for you |

Money Coach Tools

Want to Know How Much You Need to Invest?

Explore free, powerful tools from Money Coach to plan your investments, calculate SIPs, estimate returns, and stay on track with your financial goals. Simple, transparent, and actionable.

SIP Calculator

If you had invested ₹500 every month

Over a period of 1 Yrs

With the rate of return of 1%

Compare Assets

Still Thinking FD or Gold? Let’s Compare

Saving Account

₹ 6,90,750

(with 3% return)

Fixed Deposit

₹ 8,23,494

(with 6% return)

Gold

₹ 9,74,828

(with 9% return)

Mutual Fund

₹ 13,93,286

(with 15% return)

FAQs

What People Ask Before Starting

What’s the minimum to start a SIP?

-You can start a SIP with as little as ₹500 per month, depending on the mutual fund scheme.

Can I withdraw early?

+How are mutual funds taxed?

+Can I change funds later?

+Is my money safe with AMCs?

+Connect with Money Coach

Let’s Plan Your Financial Future

Whether it’s Mutual Funds, Insurance, FDs, or Loans, our team at Money Coach is ready to provide personalized advice and help you make informed decisions.